Finance

signalsUkraine lost US $10 investments this year

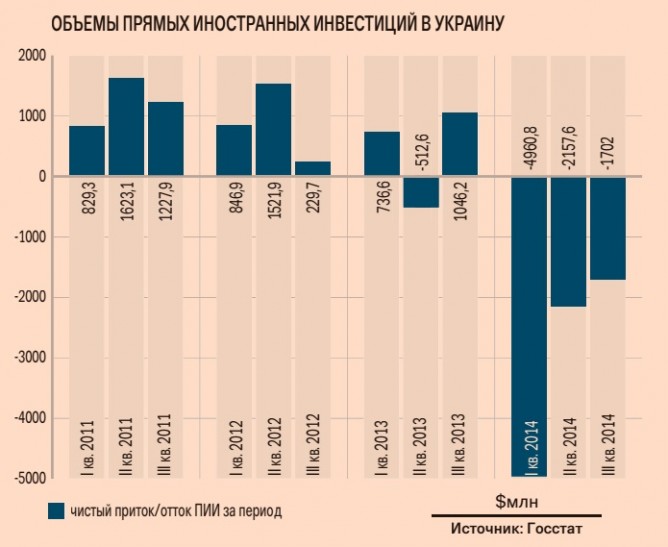

Since the start of the year Ukraine lost one seventh of its foreign direct investments (FDI). By October 1, the volume of investments of share capital into the Ukrainian economy accumulated since the start of investments amounted to US $48.5 bn, reported the State Statistics Service. At that, as of January 1 the volume of accumulated FDI reached US $56.9 bn.

Over nine months the outflow of foreign investors’ capital amounted to US $10.3 bn, while the inflow over the same period was slightly over US $1.9 bn. This means that the FDI portfolio has thinned by US $8.4 bn since the start of the year.

Exchange rate losses

Based on the data of the State Statistics Service, the results of Q3 can be easily called nearly the most dismal for the country in terms of investment losses. There was not such a high outflow of FDI even eight years ago, when Ukraine together with the rest of the world was going through a financial crisis marked by a deep recession and devaluation of the hryvnia. Devaluation of the national currency had a greater impact on FDI this time around.

The exchange rate difference caused US $9.4 bn of the US $10.3 bn reduction in the share capital, according to the SSS report. Furthermore, the net outflow of investments, not taking in account losses from devaluation, was US $967 mn.

Along with the rapid withdrawal of funds from Ukraine, the volume of inflow remains low. Investors are waiting for the stabilization of the political situation in Ukraine before making investments into the country, says Head of Corporate Finance and M&A Group at Ernst & Young in Ukraine Vladyslav Ostapenko. There was hope for restoration of investors’ trust after the presidential elections. However, the military conflict in the Donetsk and Luhansk oblasts downplayed this possibility. The government is inclined to blame the third power for this situation. In one of his speeches, Premier Arseniy Yatsenyuk stated that instability in the Donbas region is working in Russia’s favor, which is interested in investors leaving Ukraine altogether and the Donbas region in particular.

Battlefield expenses

Combat actions and the risk of a full-scale war are scaring away current and potential investors. It would have been unfair, however, to blame the situation in the Donbas alone for this. The actions of the National Bank of Ukraine in the past six months have been just as disruptive for business, assures Executive Director of the European Business Association (EBA) Anna Derevyanko. In Q3 the new rules of the NBU in the sphere of currency regulation and attempts to prohibit settlements on import transactions without the actual import of commodities to the territory of Ukraine have been particularly painful for many businesses. In addition to that, business has not felt a positive effect of the reforms announced by the government, said Derevyanko. To add injury to insult, corruption has increased. Due to this, members of the EBA have proposed that after formation of the new government the authorities should concentrate on such issues as fulfillment of their obligations under the Association Agreement between Ukraine and the EU, conducting judicial reform, fighting corruption, reducing budget expenditures in the section on the effectiveness of government expenses and conducting tax reform, said Derevyanko.

Minimum program

Western partners that the Cabinet of Ministers is counting on also remind the government about the need for reforms. U.S. Commerce Secretary Penny Pritzker earlier stated that Ukraine can count on western capital, including from Washington, only after the reforms are carried out. In fact, Ukraine should start right now. The other matter is that if the situation in the east of the country is not settled, there may not be time for reforms in the foreseeable future. “This conflict is indeed the restraining factor for new investments. It also has a negative impact on the introduction of the required reforms as the government has been primarily focused on improving the combat situation and counteracting external aggression in 2014,” the EBA concludes.

Despite the critical situation with investments, the presidential administration rather optimistically estimated new FDI into the country. As per the reform program of the president titled Strategy 2020, over five years the net inflow of foreign direct investments into Ukraine will amount to US $40 bn. For the time being, however, the government needs not so much to multiply investments, rather stop the outflow of already accumulated capital from the country.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.