Technology

extreme marketingUkrainians stopped bringing profits for mobile operators

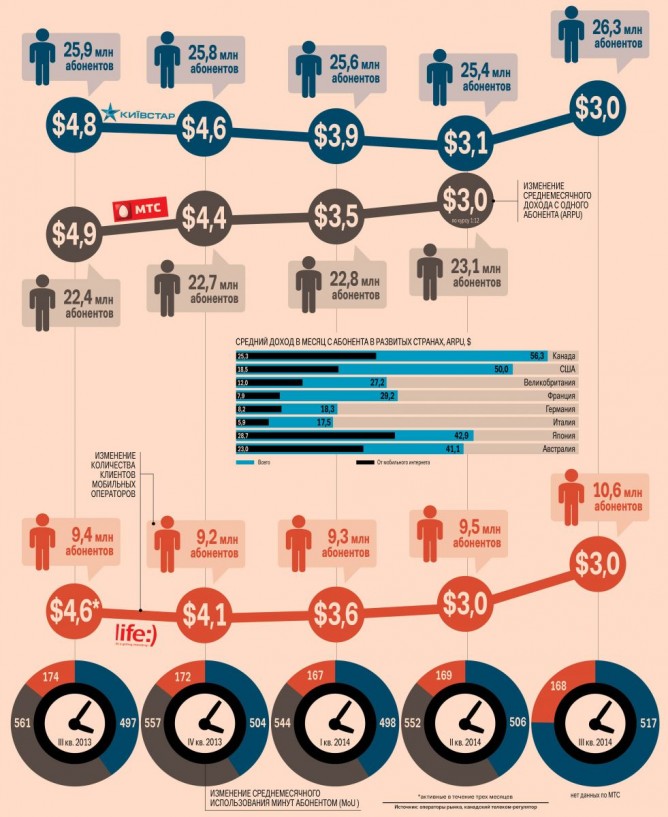

Mobile communication is just about the only major service in Ukraine, prices for which are still not pegged to the U.S. dollar. The key players on the market are still not including into their basic rates not only the devaluation of the hryvnia, but also inflation. As a result, by the end of the third quarter the average monthly revenue per user (ARPU) on the market dropped to US $3. A year ago this figure was close to US $5. Now it is almost at the level of the global minimum, which is two times lower than in such post-Soviet countries as Kazakhstan and Uzbekistan and three times lower than in Russia. In fact, the profitability of Ukraine’s mobile subscribers is currently at the level of African countries, for example Zimbabwe. But we still pay more than Pakistan or Bangladesh, where the ARPU is $1.5–2. For mobile operators it is better not to compare profitability from mobile services in Ukraine with developed European countries or the U.S. States in order to not be disdained: U.S. — US $50, France — US $30 and Greece — US $15.

Another demonstrative comparison: Ukrainian subscribers are already paying less than the players of World of Tanks, who spend on average US $4.51 per month for upgrading.

Making money on wholesale

Besides the fact that mobile operators noticeably lost revenues per customer, this business became unified. The G3 (Kyivstar, MTS, life :)) provides services for virtually the same price, while a year ago Kyivstar was considered a bit more expensive than MTS Ukraine, though MTS was more expensive than life :). In order to increase revenues at least a little this autumn operators started offering subscribers to buy a large amount of services at a wholesale price that would be slightly lower than the retail price. For example, Kyivstar, in its new package Free Country introduced in October, offered subscribers savings of 33% by simply paying UAH 90 for on-network unlimited calls and 200 minutes of calls to other networks. At the same time, Life :) introduced All Inclusive packages, in which, for example, for UAH 79 it offered 300 minutes of calls to other networks and free unlimited calls between its subscribers.

Noteworthy is that such offers may increase the average bill in the most honest manner for users. Subscribers clearly understand what they pay for. Just recently, in early summer, mobile operators used hidden techniques that could potentially spoil their reputation. For example, Kyivstar activated the Extra Money service to some subscribers automatically. This means they could accidentally run into debts, not even noticing the zeroing of their accounts. In addition, this year subscribers of the largest mobile operator could become victims of forced transfers to other service plans. Customers accept such options very sensitively.

A bit of a crackdown

This year the operators raised base rates only slightly. Kyivstar and life :), for example, had to raise tariffs for long distance calls. «The rate of cost components of services for international calls and roaming is directly dependent on the exchange rate,» said Kyivstar’s Marketing Director Svyatoslav Horban, because operators have to settle accounts with foreign partners. On average these operators increased their rates for international calls by 5 — 25%.

MTS Ukraine made no major changes in its rates for international calls, only minor adjustments. At the same time, the company has tried to compensate for the increase in costs at the expense of secondary services. For example, the rate for the Money Transfer service was hiked from UAH 2 to UAH 2.5 and the rates for text messages and other services were raised.

Despite this, Head of the Department of Telecommunications at GfK Ukraine Nadiya Tarasenko believes that mobile operators will have to revise their rates. She says this will be due not only to devaluation and inflation, but also because of the doubled fees for radio frequencies. «After the financial crisis in 2012 in Belarus the average increase in rates for certain mobile services ranged from 30% to 80%. The 3G tender is also worth mentioning. In addition to the cost of the license itself, players on the mobile market will have to make substantial investments into their networks,» she says.

Fighting for the second SIM card

Despite the fact that the mobile market has been formed over quite some time, all three major mobile operators have increased the number of subscribers this year. The main reason for such an irregular trend is the increase in sales of dual-SIM smart phones. According to GfK Ukraine, more than half of 5.5 mn regular phones sold in 2013 accounted for models with two SIM cards. This year companies sold 4.2 mn dual-SIM gadgets (smartphones and regular phones). This trend was taken into account by life :), which continues to fight for the second SIM card. As a result, the number of active subscribers of this operator increased by 1.2 million within one year. Ukrainians have to buy two SIM cards, because calls to other networks are still expensive with the internetwork rate at UAH 0.36 / min. Head of the National Commission for State Regulation of Communications and Informatization (NCSRCI) Oleksandr Zhyvotovskiy believes this barrier should gradually be lowered.

Spoiled Internet users

The mobile Internet market was formed by the end of 2013. Then it became clear that users were already paying the maximum for data traffic and operators’ revenues were practically not growing. Therefore, this year operators faced the task of teaching their users to use large amounts of traffic. This was a kind of preparation for the introduction of the next generations of mobile communications — 3G and 4G. Earlier this year, the operators tried to eliminate tariffs for every megabyte. Instead, subscribers were offered unlimited access for daily fees, which was usually UAH 1 — 2. And then each operator tried to reduce their rate to a minimum. As is seen in the reports of operators during the second quarter consumption of the Internet has grown by at least 50%. This cannot be said about revenues from this segment, which fell by a third.

Deputy Director of the GfK Ukraine Agency Hlib Vyshlynskiy believes that unlimited Internet rates may play a mean trick on operators in the future, when the country will have opportunities for the development of 3G. It is harder to sell 3G tariffs, where the bundle principle does not work, to subscribers accustomed to unlimited 2G Internet. All over the world 3G-rates are much higher than tariffs for 2G connection. And due to the absence of new technologies Ukrainian operators have modernized their data networks to such an extent that today they are among the best in the world. With the advent of 3G inexperienced users may not notice much difference in speed.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.