Finance

savingsLarge banks continue to lose deposits, while deposits in small banks are on the rise

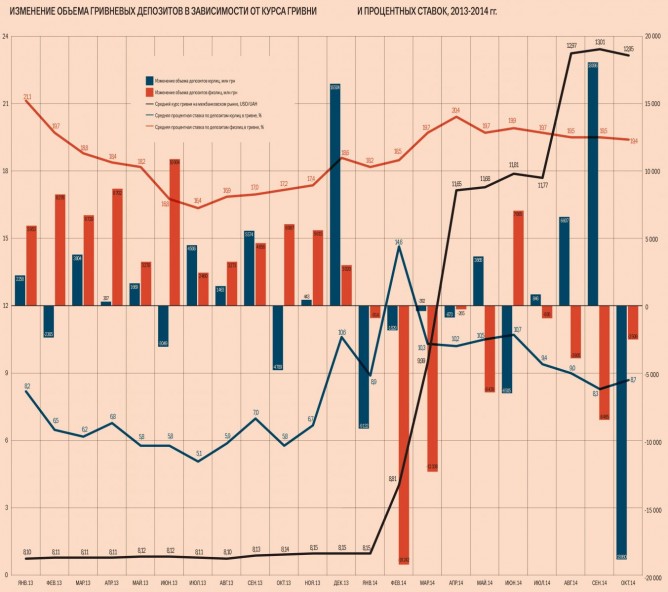

Since the beginning of the year Ukrainian banks have lost 23% of deposits in foreign currency and 13% of deposits in hryvnia. The population is highly exposed to panic. In January – October Ukrainians that have lost confidence in the banking sector withdrew UAH $8.3 bn and UAH 48 bn from financial institutions. Ukrainian citizens, not business entities, are the ones responsible for the entire amount of foreign currency deposits and 90% of hryvnia deposits withdrawn from the banks.

Indeed, the results of banks over 10 months of the year were tainted mainly by statistics of the first 6 months of the year. In the third quarter, the outflow of deposits from the banking sector slowed down. According to the NBU, in July-September Ukrainian companies and people withdrew UAH 11.5 bn in deposits. In the first 6 months of the year they withdrew almost four times as much – UAH 44.4 bn.

Also, in the third quarter business entities increased their foreign currency deposits in the amount that compensated for the withdrawal of foreign exchange deposits by individuals. In Q3 2014 the total volume of foreign currency deposits even slightly increased by US $0.7 bn to US $24 bn, though over the first 6 months of the year individuals and businesses withdrew a total of US $7.5 bn in hard currency deposits. However, the deposit remission did not last long. The outflow of foreign currency deposits started up again in September and continued in the fourth quarter.

The root of all evil

Many bankers and experts blame the NBU for the outflow of deposits. “In order to restore the trust of Ukrainians in commercial banks, many administrative restrictions should be cancelled, because they make the notion of deposits totally absurd. If people want to deposit their savings in any given bank, in the future they will face problems withdrawing their money when they need it,” says Chairman of the Ukrainian Interbank Currency Exchange Anatoliy Hulei.

As a reminder, on September 2 the NBU extended the ban on daily withdrawal of foreign currency from deposit and current accounts in amounts of more than UAH 15,000, which was introduced in February, for another three months. At the same time, at the start of autumn the withdrawal of foreign currency deposits was made possible only in the national currency at the exchange rate on the day of transaction. “The inability to withdraw deposits in foreign currency even at the end of their term has blocked the influx of foreign currency deposits in large amounts,” says Senior Analyst at Expert Rating Vitaliy Shapran.

While the amount of US $10,000–20,000 is easy to distribute among several banks, it is much harder to do so with deposits in the amount of US $50,000 and higher – expert says such foreign currency deposits make up more than half of the portfolios in banks. In order to divide such an amount one has to find a dozen reliable banks. Therefore, Shapran says many potential major investors are in no rush to deposit their money in banks. There is a similar, though less painful, situation with hryvnia deposits. On September 2, the NBU extended the ban on daily withdrawal of hryvnia from deposit accounts and card accounts in amounts exceeding UAH 150,000 for another three months.

Despite this, experts and bankers support the initiative of NBU Governor Valeriya Hontareva regarding the ban on early withdrawal of fixed deposits. The regulator intends to propose to the new parliament to amend the definition of a fixed deposit in the Civil Code as soon as it begins its work. “You cannot withdraw your deposits prematurely. You can open a deposit for an unfixed term. When you take out loans for a year, nobody demands that you return it tomorrow. If we do not manage to balance the system, we will have completely unbalanced assets and liabilities in the banking system,” explained Hontareva on the 1+1 TV channel. The faster the regulation is passed, the better, agrees Shapran. “Today, the entire resource base of banks consisting of deposits in fact consists of demand deposits,” says the expert. Up until now the ban on early withdrawal of fixed deposits was introduced in Ukraine only in times of crisis. In particular, after the beginning of withdrawal of deposits in September 2008, the NBU headed by Volodymyr Stelmakh introduced a 6-month moratorium on early withdrawal of deposits.

Costly affair

Despite the decrease in the volume of deposits, their maintenance costs banks more. While during nine months of last year interest expenses in the banking system amounted to UAH 59.2 bn, this year they grew to UAH 72.1 bn. Of course, over this period of time the number of financial institutions decreased from 178 to 166 and their deposit portfolios significantly shrunk. By the way, the increase in interest expenses was the second reason for the unprofitability of Ukrainian banks during three quarters after the creation of reserves for foreign currency loans.

Devaluation is partly to blame due to the 62% rise in the value of the U.S. dollar since the beginning of the year to UAH 12.95/USD at the end of September – the hryvnia equivalent of foreign currency deposits increased proportionally. Given the withdrawal of US $6.7 bn of foreign currency deposits within three quarters the hryvnia equivalent increased by 27% (UAH 66.4 bn). As a result, the amount of interest accrued on foreign currency deposits in the hryvnia equivalent increased without changes in the rates.

Be that as it may, the increase in interest expenses is a consequence of higher interest rates on deposits, not because of the traditionally busy season, when during the last months of the year financial institutions are in need of additional resources and attract them by raising the stakes. In this case, the growth of rates is an attempt to stop the outflow of deposits. By the beginning of October 2013 the rate on 3-month deposits in national currency amounted to 15.39% per annum, the rate on 6-month deposits was 16.87% per annum, and the rate on 12-month deposits was 17.90%, according to Standard-Rating. At the end of the third quarter of 2014 the rates on 3-month and 6-month deposits leveled off, reaching nearly 19% per annum, while the rates on 12-month deposits rose to 19.72%. At the same time, Shapran says some banks favor the most loyal customers, whom they try to hold onto by offering 30–35% annual interest rates. The situation with foreign currency deposits is similar – the rates rose from 5.33%, 6.34% and 7.34% to 7.61%, 7.85% and 8.30%, respectively. “Since the growth of rates on foreign currency deposits cannot be explained even by inflation, as in the case of the hryvnia deposits, the only reason for their increase is the competition for clients’ money,” says Shapran. Furthermore, interest rates will remain high until the inflow of deposits resumes, the report published by analysts at Credit Agricole Bank reads.

Despite this, bankers say that raising interest rates is effective only for a certain segment of customers. “Now customers are aware that placing funds at higher rates is fraught with high risks. When banks teeter on the edge of bankruptcy, they offer the most attractive terms,” says adviser to Chairman of Ukrgazbank Stanislav Shlapak. While natural persons, whose deposits do not exceed UAH 200,000 can expect refunds from the Deposit Guarantee Fund in the event that banks go belly up, major depositors have nothing to count on. Therefore, mostly minor depositors fall for high rates. And for the same reason large banks that want to create a portfolio of larger deposits prefer to stick to the golden means.

A slight paradox

During the deposit remission in the third quarter of 2014 banks did not only lose customers, but also redistributed the remaining ones amongst themselves. “In the third quarter of the year the volume of deposits in UkrSotsBank (UniCredit Bank) increased by almost 5%, both due to the increase of its deposit portfolio of existing clients and the attraction of new funds,” says Head of the Deposit Products and Current Accounts Department at UkrSotsBank Iryna Strepetova. Representatives of Ukrgazbank also noted the inflow of deposits in the corporate and retail segments thanks to the signing up of new clients. By “new” the bankers do not mean newcomers that have never used banking products in the past, but the clients of their competitors. “This year we are observing a major flight of customers from one financial institution to another,” says Shlapak. He says the fact that more than 30 banks will pull out of the Ukrainian market in 2014 also has a significant impact on the banking sector.

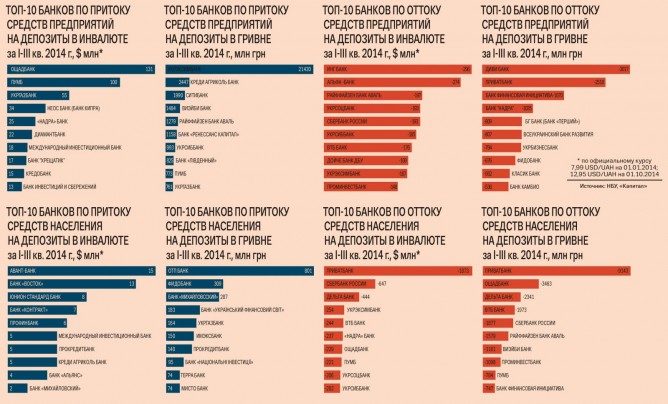

Despite the crisis of confidence in the banking system, mostly medium-sized banks in the third and fourth groups were successful in attracting people’s funds. So, among the Top 10 banks the leaders in terms of people’s deposits in local currency there is only one financial institution from the group of the largest banks – UGB – and two banks from the second group – OTP Bank and Fidobank. Among the Top 10 banks in terms of inflow of deposits in foreign currency there is only one from the second group – Credit Agricole. On the flipside, only financial institutions on the first and second groups in terms of assets are on the list of the top ten banks with the largest capital outflow.

“When the market falls, large banks lose their portfolios alongside the market. At the same time, small banks readjust quickly and lose less,” says Shapran. The fact is that they are more flexible and quickly change terms of deposit programs and, if necessary, raise interest rates. The key to their success partially lies in higher interest rates. The average market rate for 12-month deposits in national currency for individuals is now close to 20.9% per annum, according to Thomson Reuters. At the same time, for banks in the Top 10 in terms of inflow of deposits in the national currency these rates reach 25% per annum.

The truth be told, many financial institutions do not revise the rates and position their increase as time shares. For example, last August Avant-Bank, the leader in terms of inflow of foreign currency deposits of the population, launched the 100% Deposit campaign. The main peculiarity of this deposit is the annual interest rate, which is increased over the term of the deposit agreement. So, for example, for foreign currency deposits, the minimum size of which is only US $100, the annual rate may reach 12%. For comparison, the average market rate for such deposits currently stands at 9.36%, according to Thomson Reuters.

Small financial institutions manage to break into the lead in the banking sector in terms of the inflow of deposits not only with the help of higher rates. Shapran explained that unlike the major players small banks do not typically attract large volumes of deposits, as attracting small amounts is much easier.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.