Business

trendsUkraine’s aviation market ends the year on a low note

The air transport market of Ukraine is undergoing heavy turbulence. By the end of this year, it will lose several airlines and at least 30% of its passengers.

Turbulent flight

The senior management of Ukrainian airline companies had a premonition of an impending crisis this year. The consequences of the dramatic events at the end of 2013 came to the fore in January 2014. Indeed, ticket sales dropped by 30% compared to January 2013. February was calm, but the devaluation of the Ukrainian currency, which dealt a blow to demand, began gaining momentum. “Unfortunately, airline fares are pegged to the U.S. dollar. And while in winter tickets priced at US $100 were bought for UAH 800, in summer they already cost UAH 1,200, and now – UAH 1,600. Since people’s wages were not indexed, a serious outflow of passengers was observed,” says aviation market expert Yevhen Khainatskiy. Many passengers of the business segment began flying in economy class and those who previously flew in economy class began traveling on cheaper means of transport.

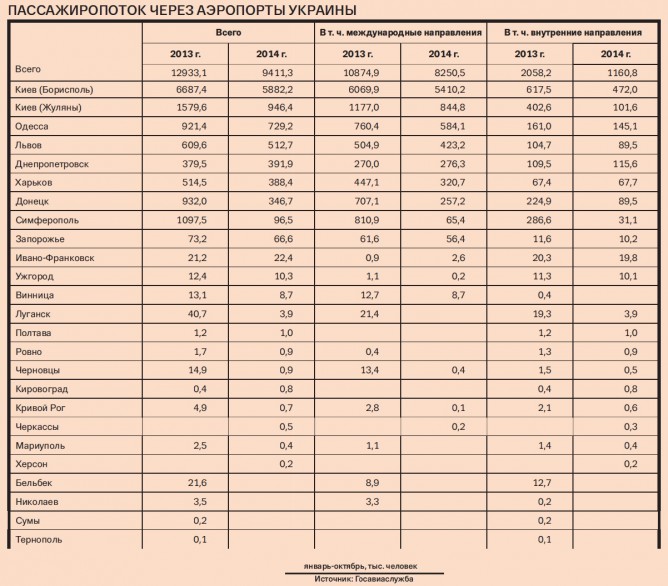

The annexation of Crimea and the armed conflict in the Donbas only exacerbated the situation. “Since March we have completely lost flight connection with Simferopol and since May – with Donetsk. In terms of traffic, these two gateway airports were second only to Boryspil,” says Khainatskiy.

The unstable political situation in the country and the ATO also had an extremely negative impact on passenger traffic. “I believe other hubs benefited from this situation – for example, Istanbul via Turkish Airlines. They managed to lure transit passengers from Ukraine,” said Deputy Commercial Director of the UTair-Ukraine Volodymyr Katerniy.

As a result, based on the results of January–October the total passenger traffic fell 27.2% to 9.41 mn compared to the same period in 2013. At the same time, the Ukrainian domestic market dropped by 43.6% to 1.16 mn passengers and the international market declined by 24.1% to 8.25 mn passengers.

Cut to the quick

New realities forced airlines to reconsider their business strategies. They started total optimization of their business processes: downsizing, reduction of fleets, reduction of flight frequency, revision of routes. For example, Ukraine International Airlines – the leading company on the market – reduced the number of aircraft from 37 to 33, refused to fly to the Russian cities of Novosibirsk and Yekaterinburg and cancelled free meals in the economy class on flights lasting up to two hours since March 1.

By the end of the year, UTair-Ukraine suspended its flights almost completely, except for charter flights for tour operators. “This year the airline has suspended flights to Luhansk, Odesa, Lviv and Kharkiv due to lower demand and to Donetsk due to the shutdown of the local airport,” said Katerniy. According to www.tickets.ua the parent airline – UTair – still has regular flights from the Lviv Airport to Kyiv and Moscow.

Foreign companies also changed their behavior in Ukraine. Emirates, Alitalia, Swiss and Norwegian Air Shuttle cancelled their flights to Ukraine and Turkish Airlines, Aeroflot, Lufthansa, Air Arabia and some other reduced the number of flights.

Snowy winter

It will be difficult for Ukrainian airlines to survive winter navigation, says Deputy Director of the Belavia Airline Igor Cherginets. “It is most likely that Ukrainians will not be spending money on holidays and trips. They will prefer to save it. The situation in the country is complicated, and foreign currency exchange rates are constantly growing,” agrees Aviation Market Expert Serhiy Khyzhnyak. He says the airlines started the winter season with a minimum margin of safety. “Usually, the financing of economic activity in the low season was somewhat covered due to high profits in the summer season. This summer airlines did not turn any profits. Therefore, their main task will be to attract capital for maintenance of operations. This can be done through bank loans and implementation of their own marketing activities aimed at attracting financial resources. For example, the programs of advance booking and ticketing,” said Khyzhnyak, noting that UIA has launched some of these programs.

Airlines have only one option – to optimize their costs in order to survive tough times, says Executive Director of the Aerojet Airline Anatoliy Mazurenko. Each carrier has chosen an exit strategy of its own. “Basically, all our major carriers owning large aircrafts (UIA, Windrose, Yanair, Dart and Kharkiv Airlines) managed to find “part-time jobs” outside Ukraine, thus providing some income and employment for their staff and reducing costs of the maintenance of “extra” aircraft in Ukraine (aircraft were leased with their crews and tech staff),” says Khainytskiy.

Cherginets believes that those airlines that will be able to carry tourists to warm countries (for example, in Southeast Asia) or receive confirmed charter programs will have a certain competitive edge. He recommends some Ukrainian airlines to compete in international tenders for the free fleet for the needs of the United Nations.

Players on the aviation market and experts agree that by the end of this year passenger traffic will see a dramatic decline. Optimists predict a fall of 25–30%, while pessimists predict a decline of 40%. Revival of the industry in the best case scenario can be expected only in the summer of 2015.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.