Technology

results of the yearThe number of UAnet’s users is growing, but they do not bring in a load of money

The Ukrainian Internet audience has grown 5-10% (2.1 mn people) since the beginning of the year, according to various estimates. By December the number of Internet users in the country amounted to approximately 20 mn per month, according to www.i.ua.

However, due to the economic crisis, the annexation of Crimea and the war in the east of Ukraine business activity decreased: advertisers started saving on budget, and users began tightening their belts on the purchase of expensive products.

Advertising web is thinning

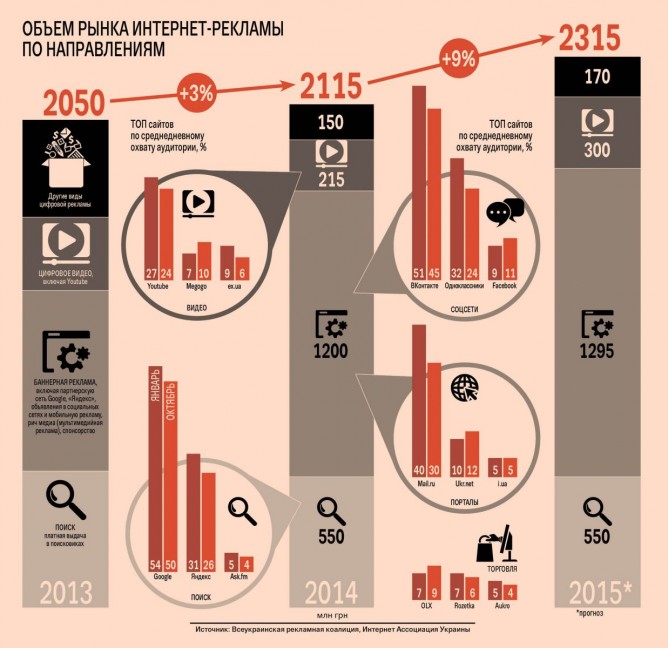

The volume of the Internet advertising market in 2014 increased 3% compared to last year to UAH 2.115 bn, according to the Ukrainian Advertising Coalition (UAC). However, the growth of online advertising is rather conventional and should not mislead consumers, says Director of UAC Maksym Lazebnyk. “Think of dollar search engines and social networks and then convert the amounts into hryvnia,” he suggests.

Head of the Business Projects Department at Yandex Leonid Shnyr says his company still gets its main profit from contextual advertising and in 2014 revenues from such content grew in Ukraine. “During the crisis it becomes particularly relevant for advertisers as an instrument for optimizing costs and understanding exactly what return you get from investing one hryvnia. Therefore, we forecast that contextual advertising will continue to grow if the uncertainty of economic growth persists,” he explains.

Managing Partner at Plus One DA Maksym Savanevskiy says banner advertising is currently stagnating and the UAC predicts that stagnation will persist in 2015.

The highest growth was registered in the category of video advertising, revenues from which for the year amounted to UAH 215 mn and in 2015 may grow by 40% to UAH 300 mn. “Video advertising is growing much faster than the market,” says Savanevskiy. YouTube is the main stronghold for video advertising. Its monthly audience in Ukraine has already reached 14 mn visitors. Advertising costs an average of US $4,000–5,000 per one thousand showings, though this figure may vary depending on the type of commercial video, its duration, target audience and the possibility of skipping it. The most popular competition to YouTube are Ukrainian video websites – Megogo.net (3.5 million visitors per month) and Ex.ua. However, their slice of the advertising pie is still negligible, says Savanevskiy. In contrast to YouTube, the audience of such services is usually limited to Ukraine or CIS countries.

TV channels earning a quick buck online

This year the largest Ukrainian media groups tried to diversify the channels of advertising revenues and wagered on advertising on partner websites. Back in 2013 Media Group Ukraine, 1+1 media, StarLightMedia and Inter Media Group initiated the Clear Sky program, which added a special video player with licensed video products to websites participating in the program.

According to StarLight Digital Sales (a member of StarLightMedia), the result of the work brought over 36 mn views into the legal field in 2014. The number of the unique Internet audience increased to 3.8 mn, accounting for 36% of the total number of people watching videos on the Ukrainian Internet. By October of this year the sales house expanded video advertising on the Internet (video stock) to 80 mn per month.

Development Director at StarLightMedia Iryna Andryushchenko predicts that prices for licensed video stock will rise in 2015, because the demand for it increases the supply by 50–60%.“Even during the crisis in 2014 inflation on it was quite high – approximately 20%, reaching up to 50–70% for premium formats. We also predict inflation for in-stream videos at the rate of 20–25% and 10% for in-page videos (content-rolls), as such stock is also in short supply, though it is higher than the licensed in-stream stock,” she said.

1+1 Media also plans to strengthen video advertising on the Internet, said Manager of the Online Advertising Sales Department at 1+1 media Maryna Kolesnikovova. “At the industry level we will try to solve the problem of measurements of the video segment, which will result in more rapid growth and clearer planning and use of video stock to meet the challenges from advertisers and will help develop additional coverage on the Internet,” she specified. Approximately 1.5 mn people watch videos on the group’s most popular Internet resource, TSN.ua, every month.

News first…

Experts note that the interest of Ukrainians in news has significantly increased this year. Savanevskiy estimated that the consumption of news content increased by 3–4 times (and in peak periods, for example, this spring, by 5–6 times).

“For example, during the events in February people were searching less for goods and services and immediately rushed to catch the latest news on the Internet,” adds Shnyr. Due to the events in the Donetsk and Luhansk oblasts this summer there were considerably less users from those territories due to the fact that there was often no electricity and many of them simply left their homes, according to his observations. But now traffic in those regions is gradually returning to the previous rates, says Shnyr.

In addition, Ukrainians began using social networks more. This is especially noticeable by data from Twitter. A year ago Ukrainian Twitter users posted up to 80,000 messages daily. In February, this figure increased to 180,000, according to Yandex Blog Search. On July 17–18 when the Boeing-777 aircraft crashed near Donetsk Ukrainian users posted approximately 1 mn Twitter messages, says Shnyr.

…then come purchases

At the same time, the interest of users in purchases declined. President of the Ukrainian Association of Direct Marketing Valentyn Kalashnyk says that even the largest segment of e-commerce, electronics and home appliances, increased only by 30% in local currency and shrunk by 20% in U.S. dollars. According to Ukrainian E-commerce Market Research conducted by the association, in 2013 the volume of the segment amounted to approximately US $1 bn, while the total volume of the e-commerce market was close to US $2 bn.

The second largest segment is the sale of tickets (transport, events and activities). According to the Google Consumer Barometer, 68% of Ukrainians buy air tickets via the Internet and 23% buy movie tickets online.

By the middle of the year, as a result of the economic situation and currency fluctuations, the traffic of online clothing and footwear stores fell. “Consumers mostly spend their money on necessity goods,” says Kalashnyk. At the same time, in the first six months of 2014 the growth of the online segment was 7%, compared to the same period in 2013. Noteworthy, in 2013 companies and stores sold US $150 mn worth of clothing and footwear on the UAnet and the growth rates in this category in previous years reached 50–100%.

The next most important segments of online sales include transport tickets, fashion (clothing and footwear), cosmetics, perfumes, accessories for vehicles, products for children, books and tickets for events.

The interest in goods has significantly increased in ads on marketplaces. For example, the number of buyers registered in Prom.ua in the first half of the year increased by 1.5 times and the number of online orders was three times higher than in the same period in 2013.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.