Business

trade warRussia banned confectionery goods made in Ukraine

On September 5, the Rospotrebnadzor (Russian Consumption Oversight Agency) banned imports of Ukrainian confectionery to Russia. The agency claims it found violations of requirements for the labeling of products in the process of examination of confectionery manufactured by Konti owned by MP of the Party of Regions Borys Kolesnykov and AVK owned by businessmen Valeriy Kravets and Volodymyr Avramenko.

Since July 2013, Russia also banned the import of confectionery goods manufactured by Petro Poroshenko’s Roshen. Therefore, the largest market was blocked for the three leading exporters, which account for almost 90% of deliveries of Ukrainian sweets to Russia.

Agonizing industry

Ukrainian confectioners could get used to the reproaches of neighboring countries, as the bans have been hailing in abundance for more than six months already. A few months after the ban on Roshen products due to Russia’s complaints about their quality, Ukraine shipments of confectionery products of AVK and Konti were returned to Ukraine. Sometime later, Belarus, which is a member of the Customs Union along with Russia and Kazakhstan, started demanding from Ukrainian confectioners licenses for supplies of their products. In particular, Belarusian officials wanted Ukrainian suppliers wanting to obtain licenses to raise the retail sale price of their sweets by several times, which would make their products uncompetitive. After lengthy negotiations and introduction of retaliatory sanctions by Ukraine – i.e. protectionist duties on Belarusian goods – Belarus canceled the licensing.

Objections

Russia’s actions are illegal, says the head of the industry association Ukrkondprom Oleksandr Baldynyuk. “This is simply outrageous. Violation of requirements for labeling is not a reason for sanitary bans because those are different scopes of regulation,” he insists.

Manufacturers are confident in the quality of their products. “The claims to AVK’s labeling filed by the Russian side are surprising. All sweets supplied by the company to Russia comply with the requirements of its legislation,” says Production Director at AVK Oleh Haryazha. He argues that since the beginning of 2014 the company has received confirmation of this from three different agencies on the territory of Russia. AVK has already applied for an explanation of claims to Rospotrebnadzor. Konti and Roshen did not respond to Capital’s inquiries. Rospotrebnadzor also refused to comment on the situation.

Baldynyuk says Russian officials override the rules of international trade law and the responsibilities assumed upon accession to the World Trade Organization.

Only few alternatives

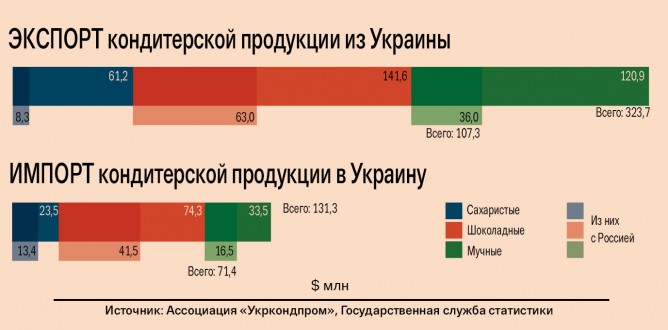

The closure of the largest market will be painful for Ukrainian confectioners. Based on information from the Ukrkondprom, in the first half of 2014 Russia received 33% of the total amount of Ukrainian exports of sweets – 41,600 t of products to the tune of US $107.3 mn. At the same time, the share of Russia in the total volume of imports of sweets during the first half of the year reached almost 55% - 23,400 t to the amount of US $71.4 mn.

Ukrainian confectioners have only few alternatives: diversification of markets and transition to production of long-life products, says Head of the Analytical Department at the AAA Consulting Company Maria Kolesnyk. Roshen was never able to regain its position. In March Roshen’s Deputy General Director Kostyantyn Mai complained that its capacities had to be cut due to the Russian embargo and new markets for the company’s products were not found at the time. At the same time, one of the company’s managers told Capital that the company could not compensate for the volume of the Russian market in the Middle East and Africa – the volumes were not comparable.

Director of the CEC Ukraine Consulting Company Oleksandr Lenhauer believes that the markets of the former CIS are the most attractive for Ukrainian confectioners. “Time and adjustment is required to conquer more promising markets,” said the expert.

No insurance for AVK

By the end of 2014 the confectionery market in Ukraine will drop by 20% - up to 730,000 t. “The industry suffers from stable negative dynamics. In the first half of 2014 the decline was 25% in real terms in all groups and by the end of the year the decline may reach 20%,” predicts Baldynyuk. Exports will decline twice due to the embargo to US $300 mn. Kolesnyk admits that the domestic market accumulates the surplus of products. However, as she explained, both AVK and Konti are in close proximity to the war zone. “The shutdown of these facilities may neutralize the surplus of products on the domestic market,” said the expert. Previously, the co-owner of Konti Borys Kolesnykov said the company is loaded at only 40% and its employees were sent on unpaid leaves due to difficulty of working in the ATO zone.

Noteworthy, Roshen and Konti own successfully operating Russian subsidiaries, whose products sell quite well on the market of the neighboring country. But AVK has no such alternatives. Haryazha says in 2012 – 2013 the company’s exports accounted for approximately 60% of its total output. At the same time, the share of sales in Russia from the total amount was close to 40%.

Kolesnyk believes the prices on the Ukrainian market will not fall. Due to the devaluation of hryvnya, the prices of ingredients rose significantly, so it is unlikely that manufacturers will lower their prices. Lenhauer notes that the retaliatory measures will not be significant for Russian confectioners – Ukrainian share of supplies in Russia’s import of sweets does not exceed 10%. Ukraine has drafted a list of Russian goods that will be banned for import, but the document has not yet been approved.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.