Economy

national debtIt is high time for Ukraine to agree on debt restructuring

The Ministry of Finance is planning to attract UAH 170.4 bn of borrowed funds next year, including UAH 110.3 from abroad, according to the draft of the national budget for 2015, which the Cabinet of Ministers introduced to the parliament on Friday and withdrew on the same day for revision. The ministry will need this money primarily to pay for old debts. However, the amount proposed in the national budget may turn out to be insufficient. Moreover, it will not be easy to attract it.

Rate difference

According to the draft of the national budget, next year the government will have to repay UAH 122 bn in loans, including UAH 74.1 bn of external debts and another UAH 59.4 bn for servicing the debts. In reality, the amount of the payments may turn out to be even higher if to take into account the actual exchange rate of the hryvnia, not the overstated rate.

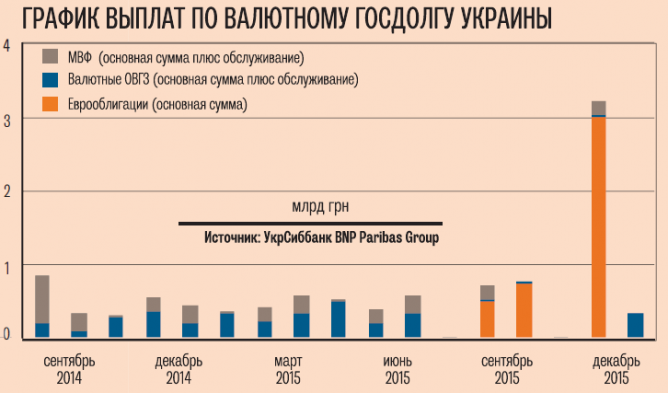

According to estimates of Senior Financial Analyst of the ICU Group Taras Kotovych, expenditures for the repayment and servicing of the direct currency national debt alone, not taking into account the guaranteed debt of state-owned companies, will amount to over US $9 bn, including US $3 bn on currency Eurobonds to Russia, around US $2 bn on currency T-bills and US $1.5 bn on loans of the International Monetary Fund. If you transfer this amount even at the exchange rate of UAH 16/US $1 the total amount of payments for the direct national debt, including the internal debt, will reach UAH 200 bn.

In addition to that, the guaranteed debt and quasi-national debt – liabilities of state borrowers, who cannot cope with debt repayment – may become an additional burden on the budget.

Head of the Analytical Department at SP Advisors Vitaliy Vavryshchuk pointed out that expenditures for the increase in foreign exchange and gold reserves to the acceptable level, for purchase of gas by Naftogaz of Ukraine and possible assistance in repayment of the debts of quasi-national borrowers, for instance Eurobonds of Kyiv or Ukreximbank, may be added to the payments of the direct national debt in hard currency. Then the total demand of the government for the currency will soar to US $15 bn, the IMF noted earlier.

Not from one’s own pocket

The mint of the NBU may help the government finance payments of hryvnia debts as it happened this year, though it will be much more difficult to gain access to hard currency. Even with the existing international support this year the Ministry of Finance and the NBU managed to borrow only UAH 8.9 bn in hard currency, at the same time paying US $11.2 bn for repayment and servicing of hard currency debts.

One should also not put hopes on attracting funds through market mechanisms in 2015. This year the government managed to perform only one placement of Eurobonds – in May for US $1 bn and only under the guarantees of the U.S. “Given the current situation, Ukraine should not hope for placement of Eurobonds on capital markets any time soon,” says Kotovych. In addition, Vavryshchuk said that the Cabinet will not be able to place Eurobonds earlier than Q4 2015.

The government will not be able to find funds on the domestic market. Placement of currency T-bills brought the national budget only US $713 mn over 11 months. For comparison, the Ministry of Finance attracted US $793 mn in December 2013 alone. Vavryshchuk says that due to the continuing outflow of currency deposits commercial banks are not inclined to spend their scarce liquidity to finance the government. Therefore, foreign donors are the only hope.

Jettison the ballast

In these conditions, Ukraine is in desperate need of national debt restructuring since 2008, says Vavryshchuk. However, opinions differ about the acuity of the threat of default and, accordingly, the need for restructuring the debts. At this moment, the Ministry of Finance is categorically against such a move. Experts that prefer the wait-and-see approach support this position. “The probability of restructuring is at the moment not that high and will largely depend on when Ukraine will be able to receive financing, including IMF loans and their volumes,” Kotovych says.

Vavryshchuk points out that the situation will be clearer by March. However, some experts suggest not to wait for default and start negotiations immediately, for example at the donor conference in January, as Chief Financial Analyst of Expert Rating Vitaliy Shapran suggests.

It is also not clear what type of restructuring it should be. On the one hand the Ministry of Finance is unlikely to resort to restructuring of debts until it repays the US $3 bn Eurobonds purchased by Russia in December 2013. “Given the existing political situation, the probability that Russia will agree to restructuring is extremely low,” believes Kotovych.

This payment, which is the largest payment next year, is to be made in December 2015. However, it is possible that Russia will demand early repayment of the Eurobonds in spring, when the official data on the GDP based on the results of 2014 is published. According to the conditions of placement, Russia will have the right to demand early repayment, if the size of the gross national debt of Ukraine exceeds 60% of the GDP based on the results of the year. Taking into account hryvnia devaluation, sovereign liabilities in the hryvnia equivalent almost doubled and new borrowings of the sovereign debt exceeded this figure at the end of this summer. Based on the results of the year it will reach 70% of the GDP, according to different expert estimates.

On the other hand, the Ministry of Finance may fulfill all market commitments and request that a part of the debts to non-market creditors – IMF and other international organizations – be written off, says Shapran. In this case, however, Ukraine may be left without new tranches of loans from the IMF. Nonetheless, this step will help reduce the size of the national debt and, accordingly, the expenditures for its servicing.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.